The promise of predictive, real time, omni-channel marketing has been around for years, yet most – even sophisticated – pharma/biotech companies have not been able to implement a model that actually works. Yes, there are databases and trackers that tell you about customer channel preferences based on, for instance, whether a customer has engaged with a particular piece of content. Yes, there are suggestion engines that recommend actions based on basic rules or simply on what the most successful reps are currently doing. But what good is preference or engagement when performance is eventually measured against dollars and Rxs? What good does an understanding of what the best reps are doing when most of your reps are – by definition – not your best reps and therefore are not able to execute like a ‘best rep’? What good does it do when you optimize one channel at a time when you only realize the true value of your commercial footprint once all channels play well together?

Well, the honest answer is: Very little. But it still is the prevalent working model today. Over 75% of companies continue to struggle with the implementation of a well-integrated system of technology, people, data, analytics, and processes that looks across the usual silos of sales, marketing, digital, sample operations, patient services etc. to really understand how those components all work together and drive the desired customer behavior – such as product adoption, growing product use, or stronger product advocacy – and ultimately sales (and Rx) (1). To make matters worse, it typically takes weeks or even months until most analytics organizations deliver insights and see them implemented. Of those companies that are ahead of the curve in terms of building such an integrated promotion response and execution capability, none of them is satisfied with the business impact of their efforts.

The inability to understand and respond quickly to customer needs is most apparent where it matters most: In product launch situations. Two recently published studies looked at the performance of US drug launches over the last decade and found 66% of them failing (2,3). Clearly, the current status quo is not good enough in today’s pharma / biotech environment.

Why, then, are advancements in this area slow and cumbersome? There is a myriad of reasons, most importantly the lack of understanding, strategy, organization, and resources focused on building the capability that can deliver predictive, real-time, omni-channel marketing. The industry has invested billions of dollars in data and commercial execution capabilities to modernize the way companies engage with their customers in a way that is adequate for the 21st century.

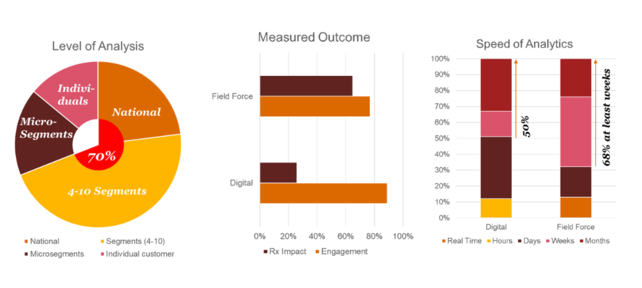

In the analytics and ‘signal provision and-execution-space’ most bio/pharma companies, however, lag significantly behind what other industries consider the standard operating model (Figure 1: Current State of Commercial Analytics).

- 70% of companies analyze data at a national or macro- segment level to find out which commercial approaches ‘typically’ work. By focusing their analytics on the average customer rather than distinguishing between strong vs. non-responders, pharmas/biotechs overinvest in often half their customers and underinvest in many others, leaving a lot of money on the table.

- Many analytics organizations don’t focus on Rx impact especially as it relates to digital investments and come up short by measuring what is easy but insufficient – customer engagement (clicks, open rates etc.) instead.

- Pharma’s and biotechs have fallen far behind in terms of speed of insight and their ability to adjust their commercial approach in response to those learnings. Rather than being able to measure and adjust customer purchase behavior and promotion response quickly, 68% take weeks or even months to delivery analytics to a business question and 6-month cycles from insight to execution.

The root causes for this disappointing situation are among others a) a lack of vision, b) technological and organizational issues, c) aggregate, static, and slow market insights with a focus on tracking engagement rather than actual impact, and d) a lack of tight and timely integration between insights and execution.

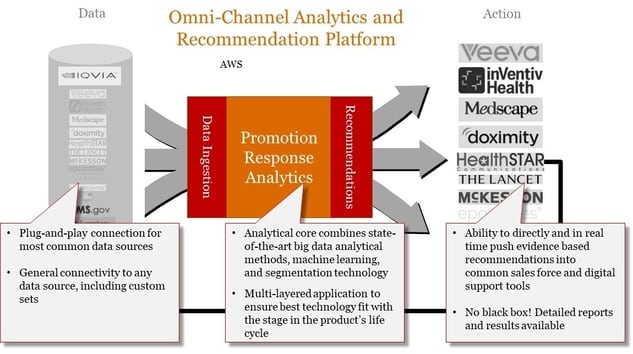

Involving a broad set of business and technology stakeholders is a first step in formulating a vision for success. While this sounds basic, many companies fail to spend sufficient time and effort in this first step on the journey towards a working omni-channel marketing capability. In terms of technology, data governance, quality and integration are foundational capabilities that require significant technology and organizational investments. Only after the data are in acceptable form can they be fed into algorithms that reliably discern which messages, channels, services and their distinct combinations in a particular customer context are most successful in driving impact. Once promotion response is not just defined as a single, static number for a customer (group), but related to a very specific context, companies end up with the necessary depth (but also complexity) of understanding customer behavior and response. Having these detailed insights at your fingertips is extremely valuable, but also raises the need to deploy rules and learning engines to handle the constant ‘pinging’ of a customer’s context, to deliver the optimal promotion strategy to the point of contact, and to observe the customer response. The result of such an omni-channel analytics and recommendation platform is an increasingly deep understanding of how to most effectively influence customers’ behavior

The realization of just individual components of such an analytics and recommendation platform have consistently delivered $10-s if not $100-s of millions in value and changed sales trajectories for launch as well as mature brands. Of course, biotechs/pharmas increasingly recognize this and most are taking active steps towards calling a predictive, real-time, omni-channel marketing capability their own within the next 3 years (1).

Literature:

- Hauser, M., Antonio Melo: Biotech and Pharma’s Omni-Channel Marketing (OCM) in 2018 and Beyond – The Role of Analytics and Recommendation Engines, PMSA, March 2018.

- Ahlawat H., Chierchia G., van Arkel P.: The secret of successful drug launches, Mc Kinsey and Company, March 2017.

- Baris, R. Hauser M.: How to Turn a Blockbuster Drug into a Commercial Failure, PMSA, April 2017.

About the author

Markus Hauser, CEO of Enginologi